Finpros Broker is a popular choice for traders who want a straightforward, reliable platform. Finpros sign up is quick and easy, making it accessible for both beginners and experienced investors. With a few basic steps, you can set up an account and dive into trading a range of assets like forex, stocks, and cryptocurrencies. The process is smooth and designed to be user-friendly, guiding you through filling out personal details, verifying your identity, and setting up a trading account. If you’re ready to start trading, Finpros Broker offers the tools and support you need right from the get-go. Here’s how you can complete the sign-up process and start trading confidently.

- Introduction to Finpros Broker

- Step-by-Step Guide to Sign Up with Finpros Broker

- Step 1: Visit the Finpros Broker Website

- Step 2: Click on Finpros Sign Up Button

- Step 3: Enter Your Personal Information

- Step 4: Verify Your Identity

- Step 5: Choose an Account Type

- Step 6: Set Up a Password and Secure Your Account

- Step 7: Make Your First Deposit

- Choosing the Right Account Type on Finpros Broker After Sign up

- Completing the KYC (Know Your Customer) Requirements

- Exploring the Finpros Broker Dashboard

- Making Your First Deposit on Finpros Broker After Sign up

- Step 1: Sign up and Login Your Finpros Account

- Step 2: Go to the Deposit Section

- Step 3: Select a Payment Method

- Step 4: Enter Deposit Amount

- Step 5: Confirm and Authorize the Payment

- Step 6: Check Your Account Balance

- Step 7: Start Trading

- Understanding the Finpros Broker Platform and Tools after Sign up

- Exploring Available Trading Options on Finpros Broker

- How to Place Your First Trade on Finpros Broker

- Tips for a Smooth Experience on Finpros Broker

- Conclusion

Introduction to Finpros Broker

Finpros Broker is a trusted online trading platform that aims to make trading accessible to everyone. It offers a wide range of assets, including forex, stocks, cryptocurrencies, and more. This variety lets users diversify their portfolios and explore different markets in one place. Whether you’re a new trader or have years of experience, Finpros Broker has tools and resources to support your journey.

One of the main reasons traders choose Finpros is its user-friendly design. The platform has an intuitive layout, making it easy to navigate and find the tools you need. You can access charts, market data, and analytics right from the dashboard, keeping everything you need in one place. Finpros also offers mobile and desktop versions, so you can trade whenever and wherever you like.

Security is a top priority for Finpros. They implement strict verification processes to protect your account and follow regulations to ensure your funds are safe. This commitment to security gives traders peace of mind, allowing them to focus on trading.

Finpros also provides excellent customer support. If you have any questions or face issues, you can reach out via live chat, email, or phone. The team is knowledgeable and quick to respond, making sure you get the help you need without delay.

Overall, Finpros Broker combines accessibility, variety, and strong security. It’s a platform designed for traders who want a simple yet powerful trading experience. Whether you’re interested in forex, stocks, or cryptocurrencies, Finpros offers the tools and support you need to start trading with confidence.

Step-by-Step Guide to Sign Up with Finpros Broker

Step 1: Visit the Finpros Broker Website

Go to the official Finpros Broker website. Double-check the URL to make sure you’re on the correct page. This helps you avoid any fake or phishing sites.

Step 2: Click on Finpros Sign Up Button

Locate the “Sign Up” button, usually at the top right of the homepage. Click on it to start the registration process.

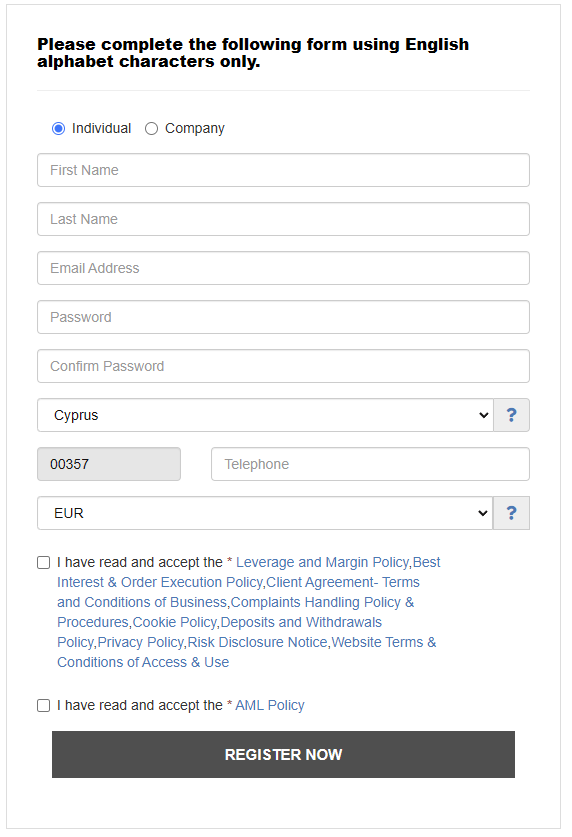

Step 3: Enter Your Personal Information

Fill out the registration form with your details, including your full name, email address, phone number, and residential address. Make sure all information is correct to avoid issues later.

Step 4: Verify Your Identity

Upload a government-issued ID and proof of address (such as a utility bill or bank statement) to confirm your identity. This step is necessary to comply with regulations and secure your account.

Step 5: Choose an Account Type

Select the account type that suits your trading needs. Finpros sign up offers various accounts with different features, so pick the one that aligns with your goals and trading level.

Step 6: Set Up a Password and Secure Your Account

Create a strong password and follow any additional security steps, like setting up two-factor authentication, to protect your account.

Step 7: Make Your First Deposit

Go to the “Deposit” section, choose a payment method, and fund your account with the minimum required deposit. After this, you’re ready to start trading.

By following these simple steps, you’ll have your Finpros Broker account set up and ready for trading.

Choosing the Right Account Type on Finpros Broker After Sign up

FinPros offers a variety of account types to cater to different trading styles and experience levels. Here’s a comparison to help you choose the right one:

| Account Type | Minimum Deposit | Spreads (EUR/USD) | Commission | Maximum Leverage | Suitable For |

|---|---|---|---|---|---|

| ClassiQ | $100 | From 1.6 pips | None | Up to 1:500 | Beginners |

| Pro | Contact FinPros | From 1.0 pips | None | Up to 1:500 | Scalpers, Day Traders |

| Raw+ | Contact FinPros | From 0.0 pips | From $2.5 per lot per side | Up to 1:500 | Scalpers, Day Traders |

| Social | $100 | From 1.6 pips | None | Up to 1:500 | Beginners, Social Traders |

Note: Spreads are indicative minimums based on average pricing in the past quarter. Maximum leverage refers to major currency pairs; leverage on other instruments may vary.

Each account type is designed to meet specific trading needs. For instance, the ClassiQ account is ideal for beginners due to its low minimum deposit and straightforward structure. The Pro and Raw+ accounts offer tighter spreads, making them suitable for scalpers and day traders seeking cost efficiency. The Social account is tailored for those interested in social trading, allowing beginners to follow and replicate the trades of experienced traders.

Consider your trading style, experience level, and financial goals when selecting an account type. For more detailed information, visit FinPros official account comparison page.

Completing the KYC (Know Your Customer) Requirements

Completing the KYC (Know Your Customer) process is essential when sign up with Finpros Broker. This verification process helps protect your account and ensures compliance with financial regulations. By verifying your identity, Finpros ensures that all traders are genuine, which adds a layer of security for everyone on the platform.

To complete KYC, gather a few basic documents. You will need a government-issued ID, such as a passport or driver’s license, which confirms your identity. Finpros also requires proof of address, like a utility bill or bank statement, to verify your location. These documents should display your full name and must be current, typically dated within the last three months.

The KYC process is straightforward. After you upload your documents, Finpros reviews them to confirm your identity and address. Make sure the photos or scans of your documents are clear and readable. This helps avoid delays and allows you to start trading sooner.

KYC verification usually takes a short time, depending on document quality and accuracy. Once Finpros verifies your information, your account will be fully activated, and you’ll have complete access to all trading features. This step is crucial for security, as it ensures your funds and personal details remain safe on the platform.

Completing KYC may seem like an extra step, but it offers peace of mind. You can trade confidently, knowing that the platform takes security and regulatory compliance seriously.

Exploring the Finpros Broker Dashboard

Navigating the FinPros Broker dashboard is straightforward, offering a user-friendly interface with a variety of features to enhance your trading experience. Here’s an overview of its key components:

- Account Overview. This section provides a snapshot of your account balance, equity, margin levels, and any open positions, allowing you to monitor your financial status at a glance.

- Market Watch. Here, you can view real-time prices of various trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, enabling you to stay updated on market movements.

- Trading Terminal. This feature allows you to execute trades directly from the dashboard, offering options to set order types, specify lot sizes, and implement stop-loss or take-profit levels for effective risk management.

- Charting Tools. Access advanced charting functionalities with multiple timeframes and technical indicators to analyze market trends and make informed trading decisions.

- News Feed. Stay informed with the latest financial news and market analysis, helping you understand factors influencing market movements.

- Economic Calendar. Keep track of upcoming economic events and data releases that may impact the markets, allowing you to plan your trading strategies accordingly.

- Support and Resources. Easily access customer support, educational materials, and FAQs to assist you in navigating the platform and enhancing your trading knowledge.

Familiarizing yourself with these features will help you utilize the FinPros Broker dashboard effectively, ensuring a seamless and efficient trading experience.

Relevant Article: FinPros Login

Making Your First Deposit on Finpros Broker After Sign up

Step 1: Sign up and Login Your Finpros Account

Start by logging into your Finpros Broker account with your username and password. This takes you directly to your account dashboard.

Step 2: Go to the Deposit Section

From the dashboard, locate the “Deposit” option, usually in the main menu or under the account settings. Click on it to start the deposit process.

Step 3: Select a Payment Method

Finpros offers various payment methods, including credit/debit cards, bank transfers, and sometimes digital wallets. Choose the one that best suits your needs and availability.

Step 4: Enter Deposit Amount

Input the amount you want to deposit into your trading account. Make sure it meets the minimum deposit requirement for your account type.

Step 5: Confirm and Authorize the Payment

Review the deposit details carefully, then confirm and authorize the payment. Depending on your payment method, you may need to complete extra verification steps, such as entering a one-time password or confirming through your bank.

Step 6: Check Your Account Balance

Once the deposit is complete, return to your dashboard to verify that the funds have been added to your account balance. Some payment methods may take longer than others, so check back if it’s not immediate.

Step 7: Start Trading

With funds in your account, you’re now ready to explore trading opportunities on Finpros Broker! Navigate to the market watch or trading terminal to place your first trade.

Following these steps will help you fund your account quickly and easily, so you can start trading without hassle.

Understanding the Finpros Broker Platform and Tools after Sign up

FinPros Broker offers a comprehensive trading platform equipped with a variety of tools to enhance your trading experience. Here’s an overview:

| Feature | Description |

|---|---|

| Trading Platform | FinPros utilizes the MetaTrader 5 (MT5) platform, known for its advanced trading capabilities and user-friendly interface. |

| Technical Indicators | Access to 38 built-in technical indicators, aiding in detailed market analysis and informed decision-making. |

| Timeframes | Offers 21 different timeframes, allowing for flexible analysis from one-minute to one-month charts. |

| Order Types | Supports six pending order types, including Buy Stop, Sell Stop, Buy Limit, Sell Limit, Buy Stop Limit, and Sell Stop Limit, providing diverse trading strategies. |

| Market Depth | Features market depth functionality, offering insights into the liquidity and volume at various price levels. |

| Expert Advisors (EAs) | Compatible with automated trading through Expert Advisors, enabling algorithmic trading strategies. |

| Mobile and Web Access | Provides mobile applications for iOS and Android, along with a web-based platform, ensuring trading flexibility across devices. |

| Economic Calendar | Integrates an economic calendar within the platform, keeping traders informed about upcoming economic events and data releases. |

| Charting Tools | Equipped with advanced charting tools, including multiple chart types and drawing tools, facilitating comprehensive technical analysis. |

| One-Click Trading | Offers one-click trading functionality, allowing for swift execution of trades directly from the chart. |

| Custom Indicators | Supports the creation and integration of custom indicators using the MQL5 programming language, catering to personalized trading strategies. |

| Multi-Asset Trading | Enables trading across various asset classes, including forex, commodities, indices, and cryptocurrencies, all from a single platform. |

| Real-Time Quotes | Provides real-time quotes and price updates, ensuring traders have the most current market information. |

| Risk Management Tools | Includes built-in risk management tools such as stop-loss and take-profit orders, helping traders manage their exposure effectively. |

| Demo Account | Offers a demo account feature, allowing traders to practice and familiarize themselves with the platform without risking real funds. |

These features collectively make FinPros Broker’s platform a robust and versatile tool for traders aiming to navigate the financial markets efficiently.

Exploring Available Trading Options on Finpros Broker

Finpros Broker offers a range of trading options, allowing traders to diversify and explore multiple markets. With access to forex, stocks, indices, commodities, and cryptocurrencies, Finpros provides flexibility for every trading style and interest. Whether you’re looking to trade major currency pairs, invest in global stocks, or tap into the fast-paced world of digital assets, Finpros has something to offer. Each trading option comes with its own tools and resources, so traders can analyze and make informed decisions. This broad selection makes Finpros an ideal choice for those who want to expand their portfolios and manage various asset classes within one platform.

How to Place Your First Trade on Finpros Broker

Placing your first trade on Finpros Broker after sign up is simple and straightforward. The platform is designed to guide you through each step, making it accessible for beginners and experienced traders alike. Before you begin, make sure you have funds in your account and have explored the market you want to trade in—whether it’s forex, stocks, or cryptocurrencies. Understanding how to enter a trade is key to getting started confidently. From selecting an asset to setting order details, Finpros provides the tools you need to make informed decisions. Here’s a quick guide on how to place your first trade and start your trading journey on Finpros Broker.

Tips for a Smooth Experience on Finpros Broker

To ensure a seamless experience on FinPros Broker, consider the following tips:

| Tip | Description |

|---|---|

| Secure Your Account | Use a strong, unique password and enable two-factor authentication to protect your account from unauthorized access. |

| Stay Informed | Regularly check the economic calendar and market news provided by FinPros to stay updated on events that may impact your trades. |

| Utilize Educational Resources | Take advantage of FinPros’ educational materials, including tutorials and webinars, to enhance your trading knowledge and skills. |

| Practice with a Demo Account | Before committing real funds, use the demo account to familiarize yourself with the platform and test your trading strategies without risk. |

| Set Realistic Goals | Establish clear, achievable trading objectives and develop a plan to reach them, helping you stay focused and disciplined in your trading activities. |

| Manage Your Risk | Implement risk management techniques, such as setting stop-loss orders and not over-leveraging, to protect your capital and minimize potential losses. |

| Keep Records | Maintain a detailed trading journal to track your trades, analyze performance, and identify areas for improvement, aiding in the development of more effective trading strategies. |

By following these tips, you can enhance your trading experience on FinPros Broker and work towards achieving your financial goals.

Relevant Article: FinPros Broker

Conclusion

In conclusion, Finpros Broker provides a robust, user-friendly platform that supports traders of all experience levels. With a straightforward sign-up process, various account types, and a range of trading tools, Finpros caters to diverse trading styles and goals. By following the KYC requirements and exploring the dashboard’s features, you can quickly get up to speed and start trading with confidence. From placing your first trade to accessing educational resources and practicing risk management, Finpros empowers you to navigate the markets effectively. Whether you’re interested in forex, stocks, or cryptocurrencies, Finpros Broker equips you with the resources to grow your skills and work toward your trading goals. Follow these tips for a smooth experience, and enjoy the journey toward becoming a more skilled and informed trader with Finpros.